A Failure To Launch?

September will be marked in our minds as the Fall That Failed To Launch. Usually, the Fall market is busy, seeing several great homes come to market and a flurry of buyer activity. It historically comes in second place to the Spring market each year, but it’s typically a robust marketplace. This Fall is a different story. There were many fewer houses that came to MLS. A flood of investor-owned condos is hitting the market; we’re waiting to see where those land in terms of prices. Those sellers will have to soften their views of value and take what they can if they must sell.

Interestingly we have seen a poor selection of quality of houses. We’re seeing houses that have been neglected by homeowners and/or not the recipients of any home improvements to help increase the value. It is challenging to sell a property that has few updates and doesn’t show well. Buyer objections are under a microscope.

So why has the market adjusted? Why does there seem to be a market correction afoot? Simply put, the interest rates have caught up to buyer’s affordability. Add in the stress test, and some buyers are looking at approval hurdles of nearly 9%. Add in the challenges that landlords with variable rates face, which explains why we are seeing a floor of condos hit the market this past month. Landlords have a fixed rent input and a mortgage output that has increased for 18 months. It’s hard for some of these owners to stay afoot by using their after-tax income to debt service their “investment.) In other words, there are a number of condo investors who are deep in negative cash-flow territory.

Is it that bad? No, this is a blip in the grand scheme of economics, Toronto’s future of real estate and consumer confidence imbalances. Could this last six months? Twelve months? Two years? No one knows, but we suspect that a slight downtick in the lending rates next year will encourage a number of new buyers to return to acquiring properties.

The critical point we always tell our clients is that if you are buying your forever home, know your numbers (financing of the property) and go for it. 10+ years, and you have nothing to worry about.

Question for listing agents:

If you list a house (or condo) with a holdback date (i.e. offer night one week away) and you expect to drive the price up but you don’t get that price, why in the world would raising the price to more than anyone was willing to pay on offer night would that be a good idea? Agents need to adapt or get lost in the shuffle. Fail to choose the right strategy and fail to maximize the value of the sale for the seller. Hire a true pro, not someone who is inflexible and will not adapt to an ever-changing real estate market.

Toronto Real Estate Market Report – September 2023

September 2023 was extremely quiet in Toronto’s central areas. There were only 812 sales. September is typically a strong month of sales; this year, it is the exception. Our overall annual markers will provide a better sense of value increase, which you can reach out to us here to discuss.

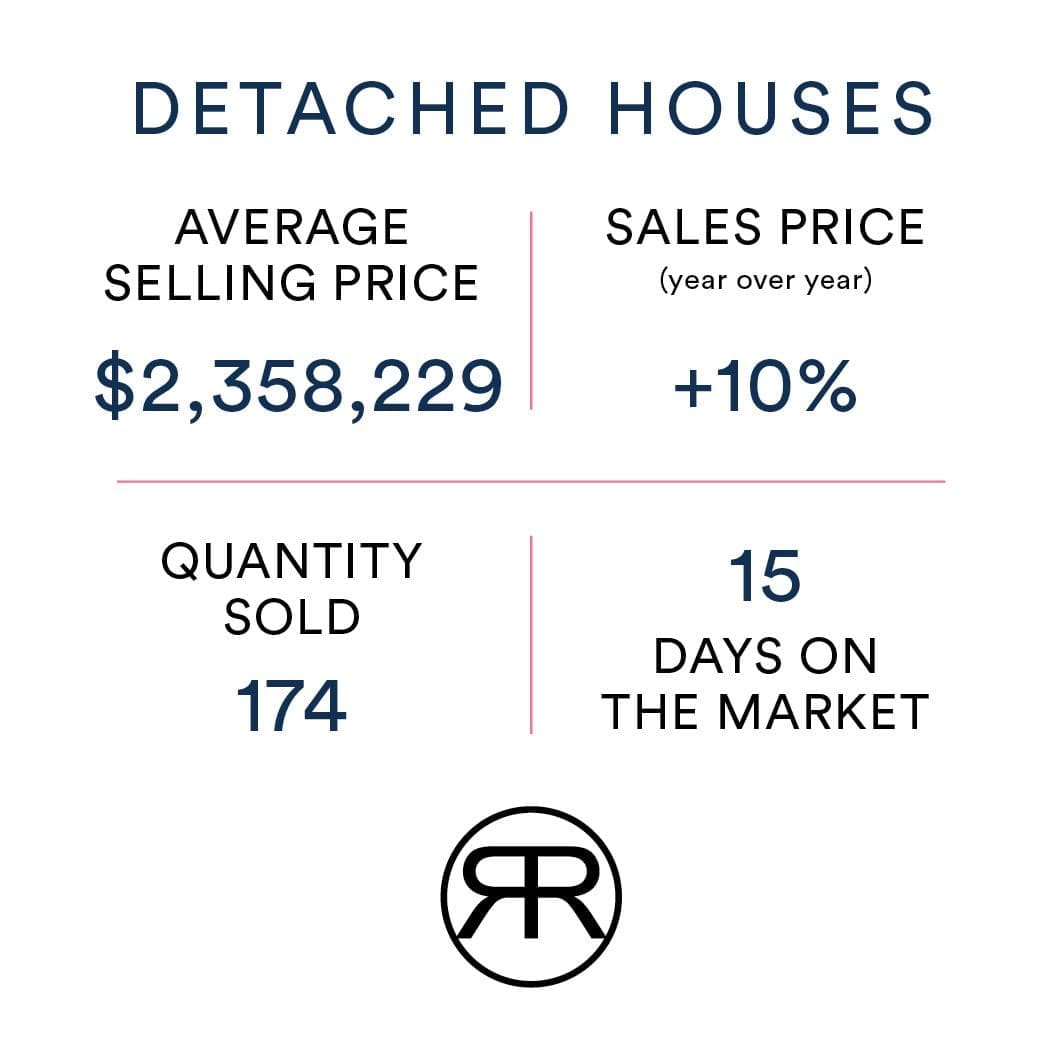

Detached Home Values

There were 119 sales in central Toronto in September 2023. The average home sold for $2,358,229, Up 10% since September 2022. The average home was on the market for 15 days – below the Toronto average days on the market – this tells us that active buyers want to buy today despite the slumping sales prices.

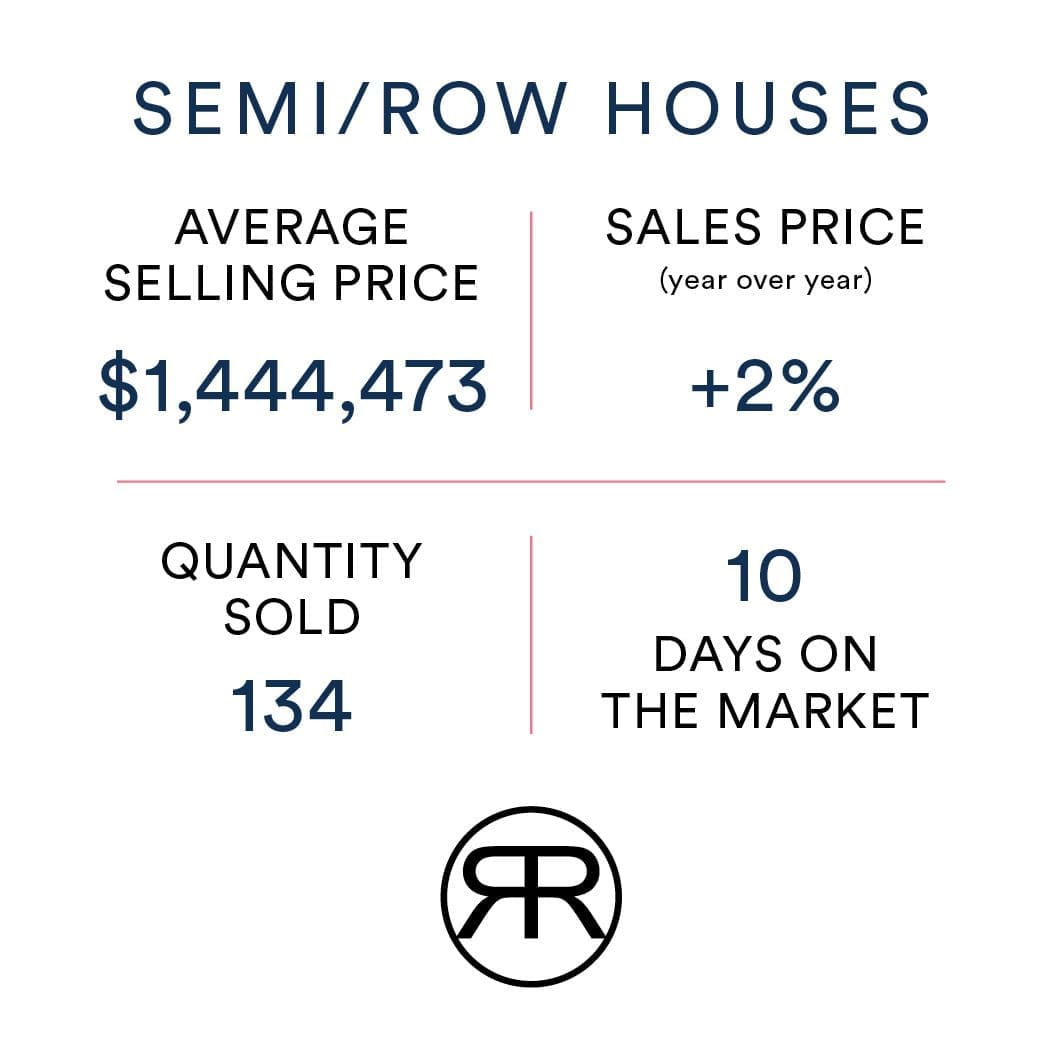

Semi-Detached & Townhouse Values

There were 134 sales in central Toronto in September 2023. The average home sold for $1,444,473 up 2% since September 2022. The average home was on the market for a relatively short time of 10 days compared to the TRREB days-on-market average.

➤ Check out our top reads for anyone thinking about living in Toronto:

- Why Parents Should Invest In Toronto Condos For Their Children

- This Is the Year For Buyers To Buy In Toronto

- Selling A Home In Toronto

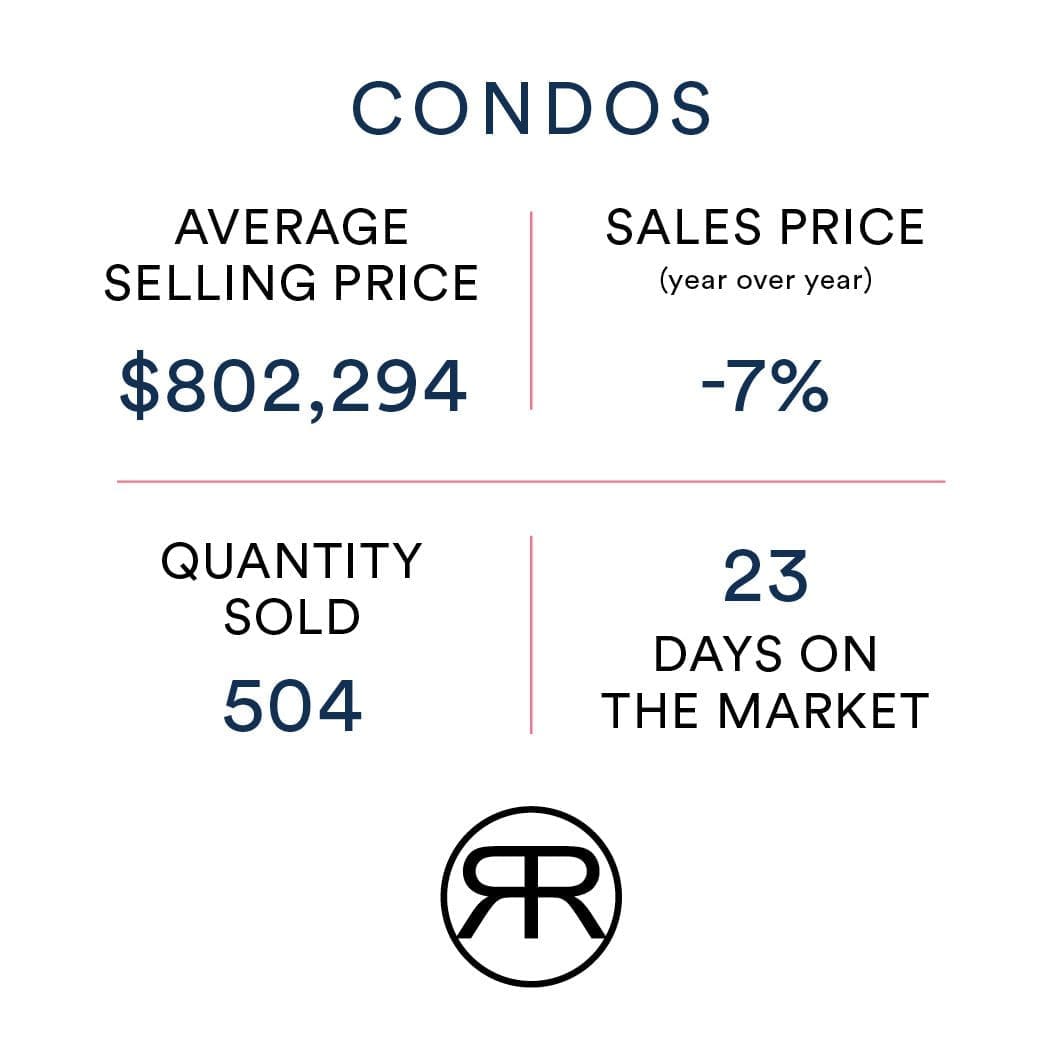

Toronto Condo Values

There were 504 condo sales—the average central Toronto condo sold for $802,294, down 7% from September 2022. The average condo was on the market for 23 days – this is an increase of days on the market compared to the previous month. Note that the correction has not impacted Toronto condos as much as the freehold housing market.

Contact us here and read through our blogs to learn more about Toronto real estate.

Want to learn more about how we can work with our clients and help them achieve their goals? We are always here to help. Click here to contact us, or click here to send us an email.

Not the Toronto real estate market report you were looking for? Here is our complete library for all reports, old and new.